-- Start of StatCounter Code for Yahoo! Site Builder

(Windows) -->

| Real time trade alerts made in OUR VERY OWN ACCOUNTS sent to you in REAL TIME with daily updated technical charts & trading plans issued DAILY to members |

Is Apple (AAPL) becoming a BUY at this level?

April 18, 2013 6.13 PM - New York NY

RE: Apple ($392.05)

With a Price to earnings multiple less than eight times earnings at this level, bargain

hunting investors will soon start to take interest, but in order for even them to take action,

Apple needs to stop sucking their thumbs in the boardroom & realize a few things...

The company could indeed be attractive to "bottom picking" investors, value oriented

mutual funds and saavy Hedge fund money managers, Let's face it Apple is going to need

to increase its dividend to at least as Microsoft's 3.2% yield compared to Apple whose

dividend yields a measly 2.5%. - Tossing chump change at hardworking investors is only

going to negatively impact their stock price, Investors liked it better when there was no

dividend, at least they weren't being insulted with having crumbs thrown at their feet.

Real time trading alerts offered by DaytradersGroup of America has identified low risk entry

points & target prices including stop-losses for APPLE INC for more info click here

Introducing Technical Analysis 101 by DayTradersGroup.com

RE: Apple ($392.05)

With a Price to earnings multiple less than eight times earnings at this level, bargain

hunting investors will soon start to take interest, but in order for even them to take action,

Apple needs to stop sucking their thumbs in the boardroom & realize a few things...

The company could indeed be attractive to "bottom picking" investors, value oriented

mutual funds and saavy Hedge fund money managers, Let's face it Apple is going to need

to increase its dividend to at least as Microsoft's 3.2% yield compared to Apple whose

dividend yields a measly 2.5%. - Tossing chump change at hardworking investors is only

going to negatively impact their stock price, Investors liked it better when there was no

dividend, at least they weren't being insulted with having crumbs thrown at their feet.

Real time trading alerts offered by DaytradersGroup of America has identified low risk entry

points & target prices including stop-losses for APPLE INC for more info click here

Introducing Technical Analysis 101 by DayTradersGroup.com

Apple Inc. (NASDAQ:AAPL): Apple Inc. (NASDAQ:AAPL) shares began the trading session with a price of US$405.00. When day trade ended, the stock ultimately dropped another

2.67% to US$392.05. The stock traded 23.8 million shares today in the last trading session, compared to its daily average of 14.57 million shares. two days in a row of heavy volume

selling is indicative of margin selling implying a bottom is near.Through the trading session, the shares reached a new 52-week low price of US$389.90. Savvy Investors may want to

find out where Apple will go from here by employing a professional trade alert service who uses certified technicians to chart out Apple's next move

Apple's market share is growing

Apple has been the dog everyone likes to beat recently. Wrong dog, that one. The company has stabilized its market share in phones and that share is now growing.StatCounter, a

market-tracking company, reported serious growth in smartphone share for Apple in February. Apple's share hit 27.2%, up from 23.3% in December. Android share stalled at the

same time. Ok, so we are guilty of shorting Apple but come.on, just since yesterday we turned $12,000 into $50,000 using stock options - join us & you could do the same.

The Yankee Group's March U.S. Consumer Survey found that "only about 15% of consumers intend to buy a Samsung phone within the next six months, while 40% intend to buy

Apple iPhones within that period." The survey also found 61% of existing Samsung owners would stick with the brand versus 85% of iPhone users.

Apple is the best and the most undervalued company on the planet -- my numbers show it is selling at a two-thirds discount to the S&P 500. Sometime in the next one to three

quarters -- perhaps as early as next week -- this market foolishness will begin to end.

Apple has been tanking, plummeting slashing the stock price nearly in half from their highs, putting the stock at the lowest it's been since December 2011.

The stock has just dipped below $400, though it bounced back above but was quickly pushed back down by thye bears today.

The crash seems to be related to Cirrus Logic, which is an Apple supplier. Cirrus makes audio chips for iPhones and iPads.

Cirrus Logic's stock is down ~10% this morning after it pre-announced earnings results that were below expectations.

Cirrus's March revenue is expected to be $206.9 million compared to expectations of $210 million, said Canaccord analyst Bobby Burleson. Its EPS is $0.55 compared to expectations

of $0.89. Cirrus also guided to $150-$170 million for the June quarter compared to consensus estimates of $195 million.

Apple is one of their largest customers. Cirrus was one of those companies people invested in as an Apple proxy. So, if its guidance is down, some people might anticipate Apple's

guidance coming in weak.

It seems investors are running from Apple in fear of next week's earnings report.but word on the street is Apple may be SWITCHING suppliers or at least not putting all their eggs in

one basket.

A few analysts have forecasted the possibility that Apple misses its own guidance, and delivers terrible June guidance. If the former happens, the stock is going to dive further.

This Cirrus news isn't helping to make people feel less concerned about Apple, however a large portion of the AAPL sales in the last few days have been from Margin Calls.

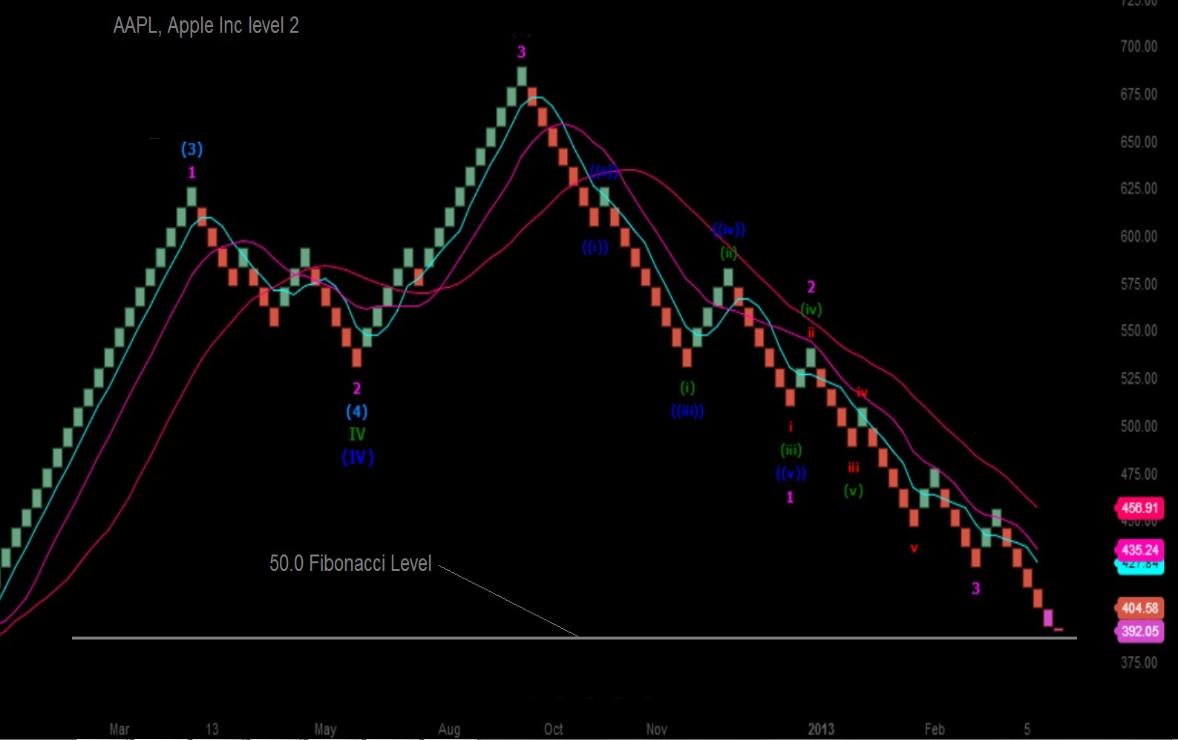

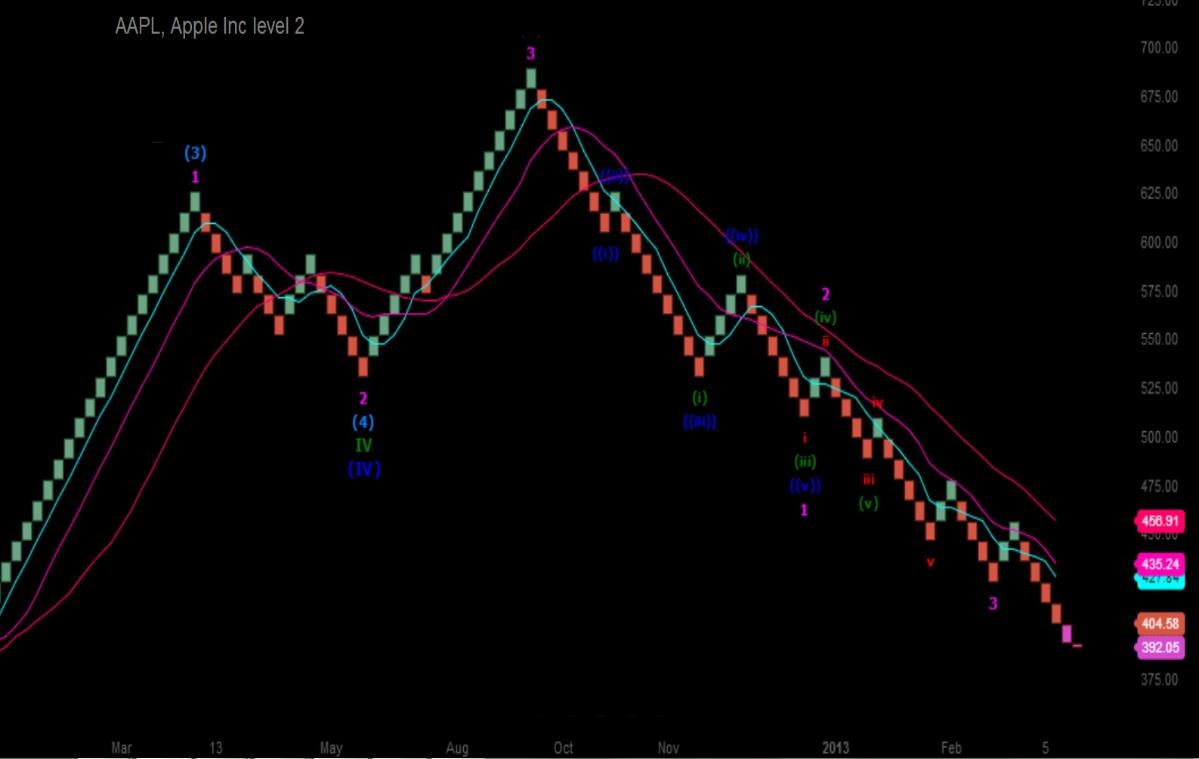

Technicals: Apple bounced today at the 50.0% Fibonacci level & within a stones throw of the 200 day moving average, also the last three times the relative strength inidcator has

read this low of a reading AAPL has bounced at least $45.00 & from a technical standpoint a bounce here is likely, although more margin calls may result in $378 being tested.

To get an edge navigating the market do what some of the largest hedge funds on earth do, they hire this market timing technician

2.67% to US$392.05. The stock traded 23.8 million shares today in the last trading session, compared to its daily average of 14.57 million shares. two days in a row of heavy volume

selling is indicative of margin selling implying a bottom is near.Through the trading session, the shares reached a new 52-week low price of US$389.90. Savvy Investors may want to

find out where Apple will go from here by employing a professional trade alert service who uses certified technicians to chart out Apple's next move

Apple's market share is growing

Apple has been the dog everyone likes to beat recently. Wrong dog, that one. The company has stabilized its market share in phones and that share is now growing.StatCounter, a

market-tracking company, reported serious growth in smartphone share for Apple in February. Apple's share hit 27.2%, up from 23.3% in December. Android share stalled at the

same time. Ok, so we are guilty of shorting Apple but come.on, just since yesterday we turned $12,000 into $50,000 using stock options - join us & you could do the same.

The Yankee Group's March U.S. Consumer Survey found that "only about 15% of consumers intend to buy a Samsung phone within the next six months, while 40% intend to buy

Apple iPhones within that period." The survey also found 61% of existing Samsung owners would stick with the brand versus 85% of iPhone users.

Apple is the best and the most undervalued company on the planet -- my numbers show it is selling at a two-thirds discount to the S&P 500. Sometime in the next one to three

quarters -- perhaps as early as next week -- this market foolishness will begin to end.

Apple has been tanking, plummeting slashing the stock price nearly in half from their highs, putting the stock at the lowest it's been since December 2011.

The stock has just dipped below $400, though it bounced back above but was quickly pushed back down by thye bears today.

The crash seems to be related to Cirrus Logic, which is an Apple supplier. Cirrus makes audio chips for iPhones and iPads.

Cirrus Logic's stock is down ~10% this morning after it pre-announced earnings results that were below expectations.

Cirrus's March revenue is expected to be $206.9 million compared to expectations of $210 million, said Canaccord analyst Bobby Burleson. Its EPS is $0.55 compared to expectations

of $0.89. Cirrus also guided to $150-$170 million for the June quarter compared to consensus estimates of $195 million.

Apple is one of their largest customers. Cirrus was one of those companies people invested in as an Apple proxy. So, if its guidance is down, some people might anticipate Apple's

guidance coming in weak.

It seems investors are running from Apple in fear of next week's earnings report.but word on the street is Apple may be SWITCHING suppliers or at least not putting all their eggs in

one basket.

A few analysts have forecasted the possibility that Apple misses its own guidance, and delivers terrible June guidance. If the former happens, the stock is going to dive further.

This Cirrus news isn't helping to make people feel less concerned about Apple, however a large portion of the AAPL sales in the last few days have been from Margin Calls.

Technicals: Apple bounced today at the 50.0% Fibonacci level & within a stones throw of the 200 day moving average, also the last three times the relative strength inidcator has

read this low of a reading AAPL has bounced at least $45.00 & from a technical standpoint a bounce here is likely, although more margin calls may result in $378 being tested.

To get an edge navigating the market do what some of the largest hedge funds on earth do, they hire this market timing technician

|